The Hidden Downsides of Throwing "Strong Buy" Stocks into Your Nice Diversified Portfolio

Medium | 10.01.2026 05:02

I’ll be honest — I get the temptation. You see some stock plastered everywhere with a “Strong Buy” label or insane momentum, and there’s this little voice saying, “Come on, just throw 5% at it. Worst case, it spices things up.”

So I actually tried to test that instinct instead of just arguing with myself about it. I took a normal, boring portfolio — 8 to 12 solid names — and in each scenario I added one “hot” momentum stock. Rebalanced monthly so I wouldn’t cheat.

Get Dankeren’s stories in your inbox

Join Medium for free to get updates from this writer.

Subscribe

Subscribe

The results… weren’t exactly inspiring. In about 60% of the runs, the Sharpe ratio got worse. Basically, you end up taking more risk without getting anything meaningful in return. And in roughly half the cases, the max drawdown got uglier too.

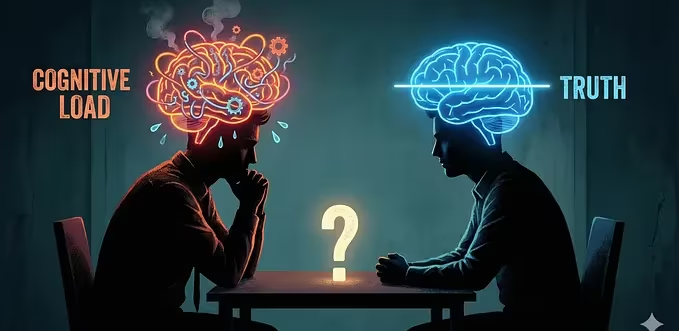

What really surprised me was how much of it came down to correlation. In a bull market, these high‑flyers look like they’re doing something magical. But the second volatility shows up, everything suddenly moves together. That “uncorrelated winner” turns into just another stock falling — usually faster than the rest.

So the big lesson for me was pretty simple: the boring stuff tends to win. Chasing shiny ratings mostly just adds noise and stress, without the payoff you think you’re getting.