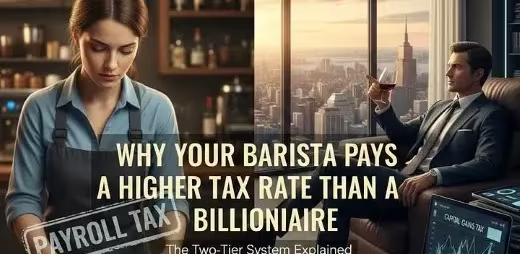

Why Your Barista Pays a Higher Tax Rate Than a Billionaire

Medium | 29.12.2025 13:51

Understanding the “Two-Tier” tax system that rewards assets over sweat.

We are raised on a very specific flavor of the American Dream: Work hard, play by the rules, and you’ll get ahead. We are taught that the tax system is “progressive,” a fancy way of saying that the more you earn, the more you contribute.

It sounds fair. It sounds logical. But if you look under the hood of the modern economy, you’ll find a glitch in the matrix.

While the average middle-class worker is watching 20% to 30% of their paycheck vanish before it even hits their bank account, some of the wealthiest people on the planet are paying effective tax rates that hover in the single digits. This isn’t a story of illegal tax evasion; it’s perfectly legal under the current IRS tax code.

1. The Great Divide: Labor vs. Capital

The fundamental “sin” of the modern tax code is how it categorizes money. To the IRS, not all dollars are created equal.

If you earn your money through labor — standing on your feet, coding, or performing surgery — you are taxed at “ordinary income” rates. According to current federal income tax brackets, these can climb as high as 37%. Furthermore, you are hit with payroll taxes (Social Security and…